Excel Blog Header

Introducing Altscreener: Dune for Deep Research

Today, we're excited to introduce altscreener.xyz — a comprehensive research platform designed to become the world's largest content library for alternative asset investing, spanning crypto and far beyond.

Think of Altscreener as "Dune foåˆr Deep Research." While Dune democratized blockchain data analysis by making complex on-chain information accessible to everyone, we're democratizing deep research and insights across the entire alternative asset landscape. Our mission is ambitious: to create the definitive resource for anyone looking to understand, analyze, or invest in alternative assets.

The alternative asset space is exploding. From memecoins and NFTs to prediction markets, tokenized real-world assets, and emerging asset classes that don't even exist yet, the pace of innovation far outstrips the availability of quality research. Traditional financial research hasn't adapted to cover these new markets, leaving investors to navigate largely on speculation, social media sentiment, and incomplete information.

Altscreener fills that gap. We're building:

- Comprehensive coverage across all alternative asset classes — crypto, collectibles, prediction markets, tokenized commodities, and beyond

- Deep research that goes beyond surface-level analysis to understand market mechanics, risk factors, and opportunity landscapes

- Transparency tools that help distinguish organic activity from manufactured metrics

- Educational content that helps both newcomers and experienced investors navigate complex markets

- Data-driven insights that cut through noise to identify genuine trends and opportunities

Whether you're researching a new DeFi protocol, trying to understand collectibles market dynamics, exploring prediction market opportunities, or investigating tokenized real estate, Altscreener aims to be the first place you turn for comprehensive, unbiased analysis.

Our vision extends beyond crypto. As traditional assets become tokenized and new asset classes emerge, the line between "alternative" and "mainstream" investing will blur. We're positioning Altscreener to be the research backbone for this transition, helping investors understand and navigate whatever comes next.

The Journey: Retroing Our Collectibles Era

Over the past year, I've had the opportunity to build in one of the most experimental corners of crypto: community-driven collectibles. What began as a neutral trading experiment on Base ultimately evolved through rapid growth, market challenges, operational adjustments, and a major pivot that led us to Altscreener.

This post looks back on that "collectibles era," explains the reasoning behind the key decisions we made, and provides context for how those experiences shaped our vision for altscreener.xyz. Today we cut over support for our collectibles assets after a 60 day (or longer support period) but you can still reach out to our support team for any help there at support@altscreener.xyz. All assets are decentralized and tradeable on the Base blockchain.

As a CEO of a project, one of the purposes of this post is an apology, justification for our pivot, and amends to our community. I got fearful of the impact of being public as a builder and it presented real risks of violence to me and my family - it's why I stepped away from the public eye which significantly impacted the momentum of our collectibles platform. We wanted to build a product that was fair for the ecosystem and that proved very difficult when others were cheating. We still show up every day to deliver for the community of traders - and are willing to do what's in our power to create fair and transparent markets in these ecosystems.

We're building altscreener because we care about education and moving forward and are forever open to feedback from community members that are still around - we want to do it the right way, not the fast way or the way that makes the most money. We want to contribute positively to this ecosystem - it's what our engineering and business teams have shown up every day to do. The intent behind this project is to make sure that we're still contributing without any active coin launches or promotion - we just want to help this ecosystem be educated so that they can make the best decisions themselves

Early Traction: Building Fairly

The first iteration of our collectibles product was intentionally designed to be neutral. We believed that in such a fast-moving market, credibility would come from fairness and transparency:

- We did not personally trade more than nominal amounts (<0.1%) of any assets launched.

- All launches were fair launch on bonding curves — no preferential allocations to insiders or influencers.

- Our community growth was organic, with verified users rather than automated activity driving adoption.

This approach worked. Within a short period, we were a top-three platform on Base measured by verified wallets and among the top five launchpads overall. Community activity across Telegram was high, volumes were real, and the platform developed strong early momentum.

Justification: our hypothesis was that neutrality and fairness would allow the market to decide what mattered. The early traction validated that approach.

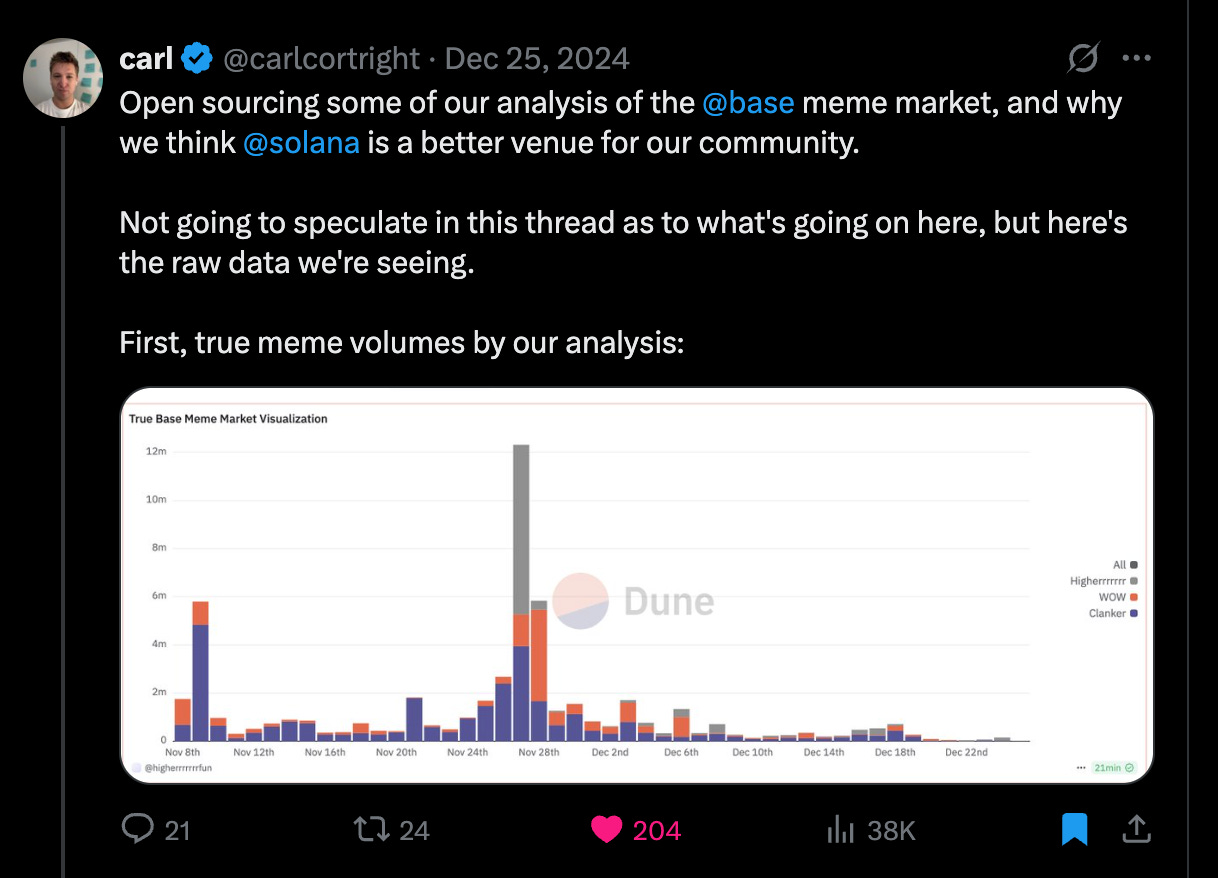

Recognizing Market Discrepancies

As traction grew, we began comparing our performance with other platforms. It quickly became clear that some reported numbers didn't align with what we saw in our own verified activity.

For example, in certain ecosystems, reported volumes appeared 50–100x higher than the activity we could attribute to organic retail participation. A large share of trading came from wallets that only transacted in a single coin and nowhere else. While this doesn't constitute proof of intent, it raised strong signals that much of the reported activity was not organic.

This put us in a difficult position. Market expectations across Base were being set by those headline numbers. Community members assumed that every coin could reach a billion-dollar market cap, because that's what the data suggested. But our verified data showed a very different picture.

Justification: calling out this discrepancy mattered because it directly influenced community expectations and risk perceptions. Without transparency, builders and traders were operating with mismatched assumptions.

Market Analysis Chart

Platform Dynamics and Ecosystem Politics

We brought our observations to the Base team, offering to collaborate on understanding potential non-organic trading. While the conversations were constructive, the platform ultimately chose to support other projects more prominently.

This wasn't necessarily unfair — platforms must make strategic choices about where to invest their support. But the practical outcome was that our project did not receive the same level of endorsement. That lack of alignment limited our ability to scale within the Base ecosystem, regardless of the strength of our community metrics.

Justification: ecosystem alignment is critical. Even if a product has traction, without platform support, it is difficult to compete against projects that are more closely endorsed.

Operational Adjustments and Security

At the same time, we encountered another factor that shaped our trajectory: operational security. As our visibility increased, so did unwanted attention. Anonymous accounts surfaced personal details about our team online, and we received other forms of pressure that made clear the risks of maintaining a highly public founder presence.

Rather than treat this as an isolated incident, we reframed it as an operational reality. Scaling consumer-facing products in crypto means preparing for the 0.001% of interactions that can present real risks. We invested in privacy, security systems, and protocols to protect the team. We could not tolerate threats against the lives of our team or their loved ones.

These steps were necessary, but they also reduced our public visibility. Without the same social presence and founder-led narrative, momentum was harder to sustain.

Justification: prioritizing safety was not optional. A company cannot execute if founders and team members are at risk. The adjustment was pragmatic, even though it came at the cost of growth.

Pivoting to Solana

By early 2025, we began migrating our product to Solana. The decision was driven by two considerations:

- The need to operate in an ecosystem where we could rebuild with new assumptions.

- The opportunity to experiment with supporting individual creators and smaller groups rather than broad launchpad-style growth.

We successfully launched a Solana-based product and provided open-source tools for other teams. However, without the same platform support and without a visible founder-led community presence, adoption was limited.

Justification: the pivot was an attempt to preserve optionality. Even if it didn't replicate the earlier traction, it allowed us to test new approaches and fulfill commitments to creators we had already engaged.

Lessons from the Collectibles Era

Looking back, there are several lessons that stand out for founders and builders:

- Community traction depends on ecosystem support. Even strong organic growth can be difficult to sustain without alignment from the underlying platform.

- Headline metrics can be misleading. Without transparency, discrepancies between reported and organic volumes can distort trader and builder expectations.

- Operational safety must be designed in. Security, privacy, and resilience are as essential as technology and community building.

- Markets move faster than narratives. When expectations are set by inflated numbers, sustainable growth becomes more challenging.

Justification: each of these lessons directly shaped our decisions — from migrating ecosystems, to adjusting our visibility, to eventually pivoting the business.

Introducing Altscreener

Rather than pursue another collectibles launchpad, we made the decision to evolve into a content and insights platform: altscreener.xyz.

Think of Altscreener as "Dune for Deep Research" — a comprehensive platform designed to build the largest content library in the world for alternative asset investing, spanning crypto and beyond. While Dune democratized blockchain data analysis, we're democratizing deep research and insights across the entire alternative asset landscape.

Altscreener is designed to provide clarity in fast-moving markets. Instead of competing on launch volumes, we are focused on:

- Highlighting where activity is organic versus manufactured.

- Tracking emerging trends across alternative assets — from memecoins and NFTs to prediction markets and tokenized real-world assets.

- Offering insights that help participants navigate with better context.

- Building a comprehensive research repository that covers everything from micro-cap altcoins to emerging asset classes that don't even exist yet.

Our vision is ambitious: to create the definitive resource for anyone looking to understand, analyze, or invest in alternative assets. Whether you're researching a new DeFi protocol, trying to understand collectibles market dynamics, or exploring tokenized commodities, Altscreener aims to be the first place you turn for comprehensive, unbiased analysis.

Justification: we believe the greatest value we can now provide is transparency and depth. By equipping communities with comprehensive information and research tools, we can help level the playing field without requiring platform endorsement or social visibility in the same way as before. The alternative asset space is expanding rapidly, but quality research hasn't kept pace — that's the gap we're filling.

Closing Thoughts

My view of collectibles remains consistent: these are entertainment-driven assets, closer to a card game in a casino than to traditional investments. There is nothing wrong with that — but like any casino, the rules should be clear. When platforms obscure how the "house" operates, retail participants are disadvantaged.

I believe the industry needs common-sense clarity around market-making behavior. This is not about heavy regulation, but about ensuring that builders and traders operate under fair and transparent rules. Without that, the risk is that excitement will outpace sustainability, damaging both participants and the broader ecosystem.

For us, the experience has reinforced one principle: we will continue building products that are net-beneficial — both in crypto and beyond. Altscreener represents the next step in that mission, and I look forward to sharing more as we launch.

We feel badly that we didn't understand the sophistication of the markets here and we've tried our best to do right by our community and the traders on Base - even while leaders in the ecosystem look the other way.

Originally published on Excel Blog on August 31, 2025